In Nigeria, you can get a personal loan through banks, online lenders, and credit unions. You can apply for a personal loan online or in person with personal and financial information, like your BVN, NIN, and employment information. Here are the top eight personal loan lenders in Nigeria:

1. Standard Chartered Personal Loan

Standard Chartered Nigeria offers an unsecured personal loan online, meaning no collateral is needed. This loan comes with an easy 60-month repayment option and interest as low as 1.08%. However, only employed individuals earning salaries are eligible for this loan. Plus, you need to be 21 years old or older. The lowest amount you can borrow is N175,000 and the highest is N35 million. If you borrow N175,000, for example, and choose to repay within a year, the monthly payment is N16,023 and the total interest is N17,278.

Per Standard Chartered's personal loan calculator, you can choose to repay your loan within a 5-year period. Documents Required: Bank statements and pay slips for the last 3 months, as well as a letter of awareness from your employer to domicile your salary with Standard Chartered Bank.

2. UBA Personal Loan

The UBA Personal Loan is available to all salary earners in Nigeria. With this loan, you can cover personal expenses, such as medical bills, home improvements, and much more! Depending on your salary and other set terms and conditions, you can borrow up to thirty million naira. The minimum loan amount is N200,000. Upon receipt of all required documentation, UBA will disburse the loan into your salary account within 48 hours.

To be eligible for the UBA Personal Loan, you must be a confirmed staff of a company and run a UBA Salary Account. In addition, your employer must be on the white list of companies for personal loans. With this loan, you can enjoy a flexible loan tenor for up to sixty months. Documents Required: A copy of your pay slip and bank statement for the last 3 months, as well as a letter of awareness from your current employer.

3. ALAT Personal Loan

ALAT by Wema Bank offers instant loans without collateral. As with everything else on ALAT, this personal loan does not require paperwork or visitation to any physical location. According to ALAT, the response time between acceptance of an offer and loan disbursement is in minutes. You can borrow up to two million naira without collateral. With a monthly interest rate of only 2%, this loan is designed to help you. The minimum amount you can borrow is N50,000.

4. Union Bank Personal Loan

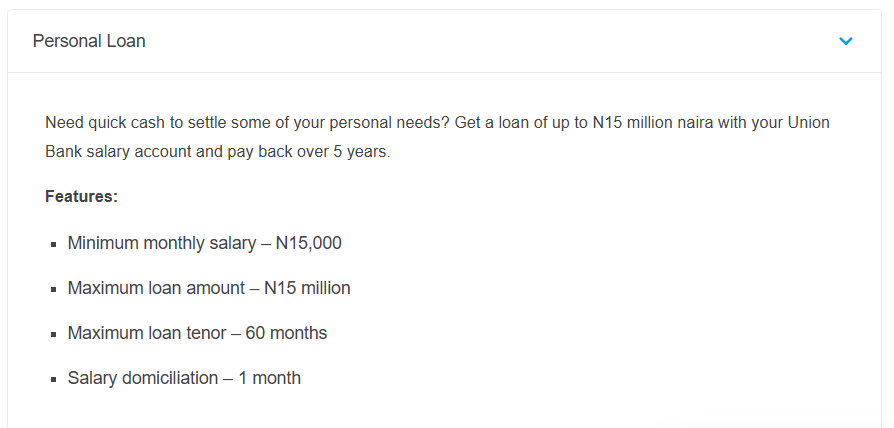

If you have a salary account with Union Bank, then you're eligible for a personal loan. The best part is the minimum monthly salary requirement, which is just N15,000. This means that if you earn N15,000 or more monthly, you can apply for the Union Bank Personal Loan. With your Union Bank salary account, which must be at least one month old, you can borrow up to 15 million Naira and pay back over 5 years.

Union Bank also offers self-employed loans of up to ₦5 million. However, to be eligible for the self-employed loan, you must have a 6-month relationship with Union Bank.

Whether you're a salary earner, self-employed, entrepreneur, or pensioner in Nigeria, Union Bank has got a loan for you.

5. Access Bank Personal Loan

Your future plans can be put into action today with the Access Bank personal loan! If you are an employee in Nigeria and have a salary account with Access Bank, you can apply for a personal loan. Applicants with terminal benefits can borrow up to 75% of their net annual salary. On the other hand, applicants without terminal benefits can borrow up to 50% of their net annual salary.

With up to 36 months of tenure, this loan is structured to meet your individual needs. Some of the requirements include a copy of employment ID, BVN, letter of lien, and letter of confirmation. To begin, complete the Personal Loan Application Form and submit it to the nearest Access Bank branch.

6. Wema Bank Personal Loan

If you have a current or savings salary account with Wema Bank, then this personal loan is available to you. Also, this product is available to salary earners under an association. Both existing salary account holders and new customers are eligible for this loan. However, as a new customer, you must provide proof of consistent salary payment for the most recent 3 months.

Depending on your income and the company you work for, you can borrow up to ₦4 million. Once again, depending on the company you work for and your salary, you have up to two years to repay the loan. In order to qualify, you must earn a minimum of ₦30,000 and domicile your salaries and allowances with Wema Bank.

7. First Bank's Personal Loan Against Salary

First Bank's Personal Loan Against Salary (PLAS) is targeted at salary account holders in Nigeria. This product is designed to provide finance for employees who have salary accounts with First Bank. If you are an employee of an approved company and want to move your salary account to First Bank, you're eligible for a personal loan.

With the PLAS, you get up to 60 months of repayment options, subject to your retirement age. For the application, a guarantor isn't required. To apply, complete the PLAS Form and submit it at the nearest First Bank branch.

8. Stanbic IBTC Personal Loan

Stanbic IBTC Bank offers an unsecured personal loan to employees with a minimum monthly income of N20,000. However, your salary account must be domiciled with the Bank to be eligible. Plus, you must be 21 years or older, but not over 60 years. Furthermore, to be eligible for this loan, you must have been with your current employer for six months or longer and have a satisfactory credit bureau report. Upon approval, the money will be disbursed directly into your Stanbic salary account.

Note: When getting a personal loan in Nigeria, loan interest and repayment terms are the two most important factors to consider.

Comments

Post a Comment